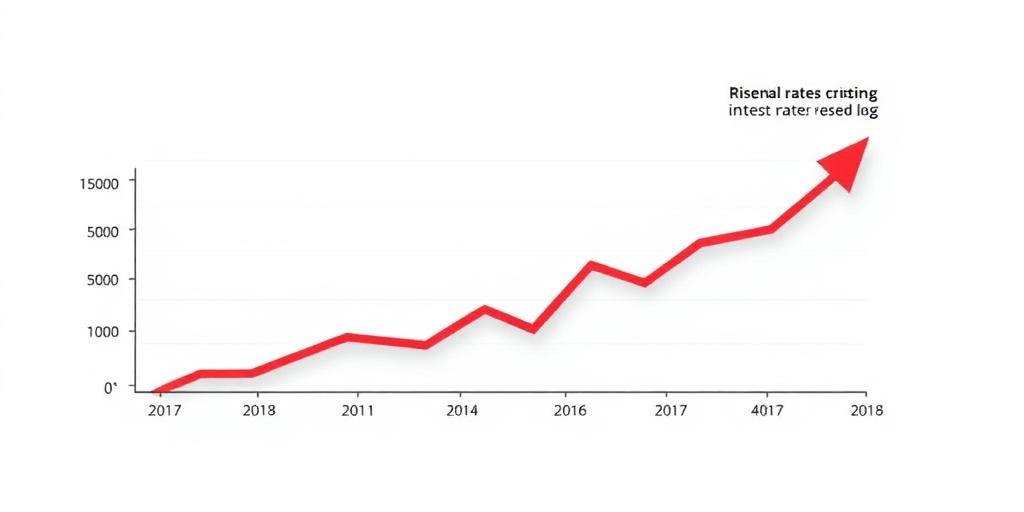

How Rising Interest Rates Affect Your Personal Loans and Investment Choices

Interest rates play a pivotal role in shaping our financial landscape, influencing everything from the cost of borrowing to the returns on investments. When interest rates rise, it's essential to understand the implications for your personal loans and investment choices. This article provides a clear and informative overview of how rising interest rates can impact your financial decisions.

Impact on Personal Loans

Increased Borrowing Costs: As interest rates climb, new personal loans become more expensive. This means higher monthly payments and a greater overall cost over the life of the loan. If you're considering a personal loan for any purpose, factor in the increased expense.

Existing Variable Rate Loans: If you have existing personal loans with variable interest rates, expect your monthly payments to increase as the benchmark interest rate rises. Review your loan terms to understand how your rate adjusts.

Refinancing Considerations: Rising interest rates might make refinancing less attractive. If you were considering refinancing to lower your payments, the higher rate environment may negate any potential savings. Evaluate the costs and benefits carefully.

Effects on Investment Choices

Fixed Income Investments: Rising rates can impact fixed income investments like bonds. Existing bonds with lower interest rates may become less attractive as newer bonds are issued with higher yields. Bond values might decrease in the short term, but reinvesting at higher rates can improve long-term returns.

Stock Market Impact: Higher interest rates can affect the stock market. Increased borrowing costs for companies may lead to slower growth, potentially impacting stock prices. Some sectors, like utilities and real estate, which are sensitive to interest rate changes, may experience volatility.

Savings Accounts and CDs: On a positive note, rising interest rates typically lead to higher yields on savings accounts and certificates of deposit (CDs). This can be an opportunity to earn more on your savings, but be sure to compare rates from different institutions to maximize your returns.

Strategies for Navigating Rising Rates

Review Your Budget: Assess your current financial situation and adjust your budget to account for potential increases in loan payments or changes in investment returns.

Prioritize Debt Repayment: Consider accelerating your debt repayment to minimize the impact of rising interest rates. Focus on high-interest debts first.

Diversify Investments: Diversification is key to managing risk. Spread your investments across various asset classes to mitigate the impact of interest rate fluctuations.

Seek Professional Advice: Consult with a financial advisor to get personalized guidance based on your financial goals and risk tolerance. They can help you create a strategy tailored to your specific needs.

Conclusion

Rising interest rates can significantly impact your personal loans and investment choices. By understanding these effects and taking proactive steps to manage your finances, you can navigate the changing rate environment and make informed decisions that support your long-term financial well-being.