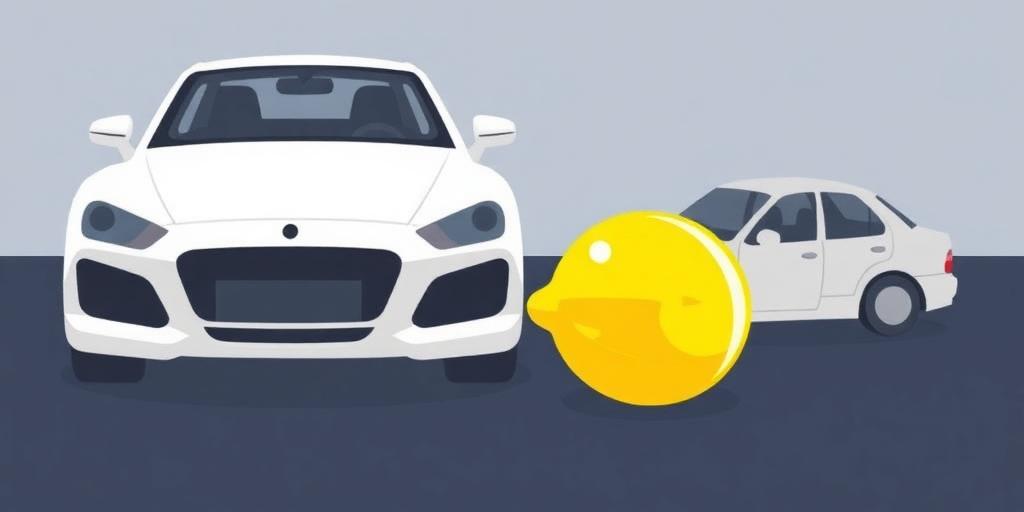

The Lemon Problem in Used Asset Markets (and Beyond)

The "lemon problem," a concept first introduced by economist George Akerlof in his seminal 1970 paper, describes a situation where asymmetric information leads to market inefficiencies. This issue is particularly prevalent in used asset markets, but its implications extend far beyond. Let's delve into the depths of this intriguing economic challenge.

Understanding Asymmetric Information

The core of the lemon problem lies in asymmetric information. This occurs when the seller possesses more information about the quality of a good or service than the buyer. In the context of used assets, like cars, the seller knows the vehicle's history, maintenance record, and any hidden defects, while the buyer typically has limited insight.

The Downward Spiral

Because buyers are wary of purchasing a "lemon" (a defective product), they are only willing to pay a price that reflects the average quality of goods on the market. This average price is lower than what a seller of a high-quality item ('peach') would accept. As a result, owners of peaches are discouraged from selling, leaving primarily lemons on the market. This further decreases the average quality, leading to even lower prices, and the cycle continues. Eventually, the market can shrink significantly or even collapse altogether.

Real-World Examples

- Used Car Market: This is the classic example. Potential buyers are often skeptical about hidden issues, leading to lower offers and a reluctance from owners of well-maintained cars to sell.

- Insurance: Insurers face the lemon problem when customers with higher risks are more likely to seek insurance, driving up costs for everyone.

- Credit Markets: Lenders struggle to assess the creditworthiness of borrowers, potentially leading to higher interest rates and limiting access to credit for some.

Mitigating the Lemon Problem

Fortunately, several mechanisms can help mitigate the adverse effects of the lemon problem:

- Warranties and Guarantees: Offering warranties or guarantees assures buyers of the product's quality, reducing their risk.

- Reputation and Branding: Establishing a strong brand reputation encourages trust, as buyers believe the seller has a vested interest in maintaining quality.

- Third-Party Inspections and Certifications: Independent inspections can provide unbiased assessments of product quality, reducing information asymmetry.

- Information Disclosure Requirements: Regulations that require sellers to disclose relevant information about a product's history can improve transparency.

Beyond Used Assets

The lemon problem's principles can be applied to a wide range of situations where information is unevenly distributed. From online marketplaces to labor markets, understanding its dynamics is crucial for creating more efficient and equitable systems.

Conclusion

The lemon problem highlights the importance of information in markets. When buyers and sellers have unequal access to relevant data, it can lead to market failures and reduced overall welfare. By implementing strategies to reduce information asymmetry, we can foster more efficient and trustworthy markets for all participants.