Understanding Herding Behavior in Financial Markets

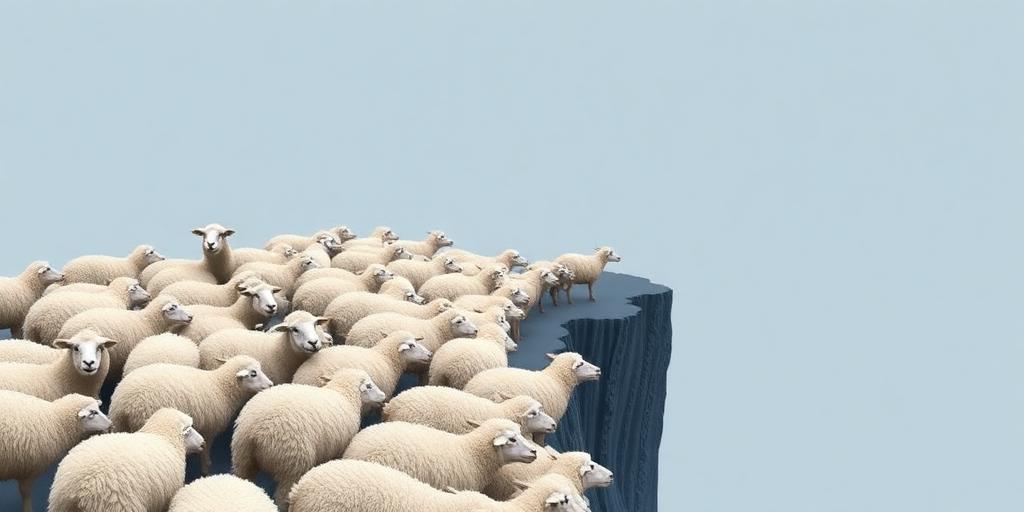

Herding behavior, a common phenomenon in financial markets, refers to investors following the crowd rather than making decisions based on their own independent analysis. This can lead to market inefficiencies and increased volatility. In this post, we'll explore the causes and consequences of herding behavior, providing insights into how it impacts investment strategies.

What is Herding Behavior?

Herding behavior occurs when investors mimic the actions of a larger group, often disregarding their own information or analysis. This behavior can be driven by various psychological and social factors, leading to irrational market movements.

Psychological Factors Driving Herding

Several psychological factors contribute to herding behavior:

- Fear of Missing Out (FOMO): Investors may jump on the bandwagon to avoid missing out on potential gains.

- Social Proof: People tend to trust the wisdom of the crowd, assuming that if many others are doing something, it must be right.

- Loss Aversion: The fear of losing money can drive investors to follow the herd, hoping to minimize potential losses.

- Information Cascades: When investors rely on the actions of others as a source of information, it can create a cascade effect, where initial actions influence subsequent decisions.

Consequences of Herding Behavior

Herding behavior can have significant consequences for financial markets:

- Market Bubbles: When investors blindly follow the crowd, it can inflate asset prices beyond their intrinsic value, creating market bubbles.

- Increased Volatility: Herding can amplify market swings, leading to sudden and drastic price changes.

- Inefficient Markets: Herding behavior can distort market signals, making it difficult to accurately assess the value of assets.

- Financial Crises: In extreme cases, herding behavior can contribute to financial crises, as irrational exuberance is followed by panic and sell-offs.

Examples of Herding Behavior

Several historical events illustrate the impact of herding behavior:

- The Dot-Com Bubble (1990s): Investors poured money into internet companies without proper analysis, leading to unsustainable valuations and an eventual market crash.

- The Housing Bubble (2000s): The widespread belief that housing prices would continue to rise led to excessive borrowing and risky investments, contributing to the 2008 financial crisis.

Strategies to Avoid Herding

To avoid being swayed by herding behavior, consider the following strategies:

- Conduct Independent Research: Make investment decisions based on your own analysis of fundamental factors.

- Diversify Your Portfolio: Spreading your investments across different asset classes can reduce the impact of market volatility.

- Stay Disciplined: Stick to your investment strategy, even when others are making drastic moves.

- Seek Expert Advice: Consult with financial professionals who can provide objective guidance.

Conclusion

Herding behavior is a powerful force in financial markets that can lead to irrational decisions and significant consequences. By understanding the psychological factors that drive herding and implementing strategies to avoid it, investors can make more informed choices and protect their portfolios from market volatility.